Disruptive Technologies for COTS Products: Software Defined Radio (SDR) Trends Over the Last Year

Trends in the software defined radio (SDR) market over the last 12 months have been centered around increasing performance while simultaneously navigating through challenges brought on by the COVID-19 pandemic. While a lot of capabilities in SDRs stem from advances in commercial-off-the-shelf (COTS) technologies enabling these advanced platforms, issues related to supply chain shortages for semiconductors have been particularly troubling.

This article discusses the types of COTS RF components, field-programmable gate array (FPGA) technologies, as well as capture, storage and playback solutions that had been driving the SDR industry forward over the past year. Alongside this, it discusses the unique challenges faced in the design and development of SDRs due to the global shortage of semiconductor based technologies.

SDR Technology Trends Over the Last 12 Months

Extended capabilities for a variety of industry applications have been brought on by advances in SDRs with integrated COTS technologies. For starters, releases of convertor devices with higher sampling rates and bandwidths lead to higher instantaneous bandwidth SDRs. Instantaneous bandwidth generally refers to what is available at the output of the analog-to-digital convertor (ADC). This is for complex IQ (in-phase and quadrature component) pairs of data, most often used in SDR, and corresponds to the sample rate of the ADC (whereas for real RF signals, this is one-half the sample rate, by Nyquist’s theorem). As well, increases in digital throughput (rate of data flowing to/from SDR from/to host system) has been important for passing this huge amount of data to a host system for processing. Combining both features in a one package solution has also been a trend in the industry. Such products that offer the highest performance radio front end capabilities, as well as processing and storage capabilities.

This instantaneous bandwidth and increased data throughput is crucial for spectrum monitoring due to this application requiring capture of a very wide bandwidth of the spectrum almost instantaneously, for such tasks as ensuring clear communication channels, monitoring restricted areas for interference, and so on. Similarly for electronic warfare (EW) systems, the need to identify and counter threats, including surveillance and/or tracking radars, is critical to mission success. EW relies on detecting these threats over a wide capture bandwidth near instantaneously and providing counter measures.

Technologies enabling these capabilities have included new gigasample per second (GSPS) high speed convertors, high performance FPGAs and IP cores, as well as ultra high speed optical transceivers (qSFP+ 100G links) and their associated PCIe-based NICs.

JESD204B interface based ADC/DACs are particularly crucial for enabling these wider bandwidths, as they allow for synchronizing multiple ADCs and the FPGA, thus increasing instantaneous bandwidth. Such advances in wide-bandwidth capturing and monitoring systems would not be possible without this interface.

FPGA with RFSoC technology has also been an important trend. For instance, the Xilinx Zynq UltraScale+ FPGA and Intel Stratix FPGA both offer high-throughput digital signal processing (DSP) and IP cores for highly parallel tasks like onboard forward error correction (FEC), JESD204 implementation, and digital up/down conversion (DUC/DDC). Integrating the latest Ethernet technology IP cores into FPGAs has also been crucial for packetizing such high amounts of data for sending over qSFP+ transceiver ports, which enable the lowest latency SDRs.

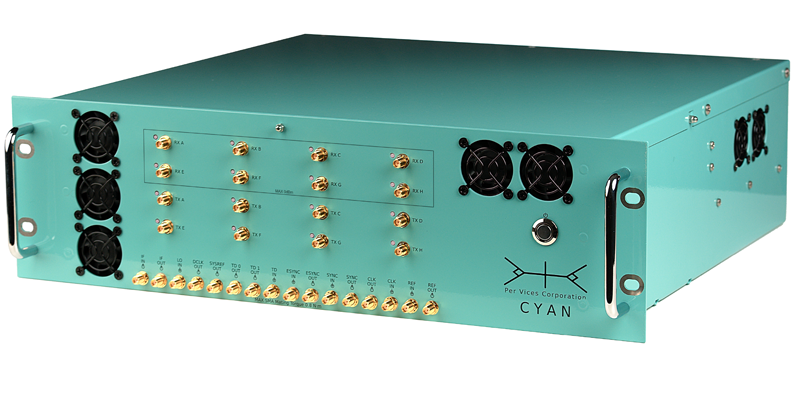

The latest high-end SDR products have taken advantage of these COTS technologies. In terms of instantaneous bandwidth, the Pentek 58891 offers 400MHz, NI Ettus X410 offers 500MHz, and Per Vices Cyan offers 1GHz (with 3GHz set to be released).

Different FPGA technologies tend to be used by different SDR companies. For instance, the X410 uses an RFSoC which provides customers with access to the Xilinx Zynq Ultrascale+ ZU28DR for on board processing; Per Vices Cyan platform utilizes a Intel Stratix 10 SoC and has multiple external storage and playback equipment that include FPGA based NICs for lossless data transfer. Each of these are attractive in their own way to different audiences; the X410 offers more open access but limited resources and the Cyan platform requires an FPGA license but offers more FPGA resources (logic blocks for your own development, etc.). Throughput for the X410 had increased from 40Gbps to 100Gbps over 2 optical QSFP28 transceiver ports whereas Cyan uses four 40Gbps or 100Gbps link using qSFP+ ports.

Challenges Faced by the SDR Industry In the Past Year

While the ability of these COTS technologies to provide unprecedented capabilities to the SDR industry is noteworthy, it has not been entirely straightforward for SDR manufacturers to adopt these technologies. The biggest challenge faced in 2021 by manufacturers worldwide (Sony PS5 systems, cars & trucks, cell phones, etc), with SDRs being no exception, is associated with the supply chain for semiconductor based technology. The latest in graphics cards technologies, memory chips (SD based RAM), microprocessors, FPGA and complex SoC technologies, and many other microelectronic components (ADC/DAC, solid state amplifiers, etc. ) are all in short supply and will likely continue to be so for part of 2022.

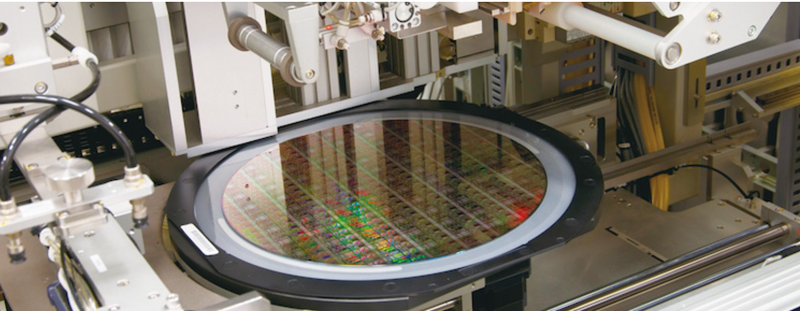

Numerous causes of this semiconductor shortage have been reported. Increased demand for semiconductor based technologies were caused by the shift to work from home, as more cell phones, laptops, and other electronics were required. Along with this, a decreased supply due to material shortages due to natural disasters, fires, as well as reduced production capacity at semiconductor facilities, was particularly problematic. Significant personnel at semiconductor foundries were lost due to strict COVID-19 measures, especially in China where the majority of semiconductors are manufactured. Multi-billion-dollar wafer fabrication plants are designed to operate 24/7, 365 days a year and require significant personnel for everything from maintenance to cleaning to engineering staff. Keeping a facility much cleaner than an operating room is a challenge in itself. This challenge was further exacerbated by disasters such as the Taiwan drought; leading to a lack of large amounts of ultra-pure water used to clean factories and wafers.

Moreover, the shortage was intensified from anxious chip buyers, who were concerned about supply chain security amid global disruptions, resulting in buying more chips than the industry intended. The car industry was particularly volatile in their approach to purchasing chips, as the car industry bounced back much quicker than forecasted, despite having canceled their chip orders during shutdowns caused by the pandemic. Car manufactures worldwide used their strong buyer position and acquired a large market share of chips despite the lack of supply from fabrication facilities.

The aftermath of the disruption is particularly noticeable by companies who now have to acquire chips that are in short supply. Overall, the demand for chips remains strong but are hard to come by. This has even led to the increase in fake components on the market, resulting in having to be cautious when purchasing products.

For SDR company’s like Per Vices, we have done everything from having increased costs on ICs and the manufacturing process, to redesigning entire circuit boards with different components, to building some circuits ourselves.

Addressing this shortage, Taiwan Semiconductor Manufacturing Company (TSMC), who are responsible for producing about 80% of micro-controller chips used in cars, said it would invest US$2.87 billion to expand capacity at its fabrication facility in Nanjing, China. While this is good news to various industries, this will not to be changing the status quo in the near future, as investing in and developing a production line for a new chip product can take weeks, if not months, and adding significant new wafer fabrication capacity takes years.

What to Expect for the Future of the SDR Industry

As pointed out, it takes a long time for fabrication facilities to be upgraded to produce new chips. That being said, it is highly probable that chips will be developed and manufactured at higher sampling rates, able to work in higher frequency ranges, while also advancing in terms of more integrated RF and digital systems with increased features embedded in these new chips. Also, the ability to send more IQ data over higher data rate optical based transceivers will result from the latest revisions of the JESD204 interface framework as well as better FPGA IP cores to packetize data and implement newer protocols.

In terms of industry applications, with the ever increasing use of the spectrum, important changes such as spectrum sharing policies will be increasingly used to monitor the diminishing number of spectrum bands. Monitoring, capturing, storing and playback of more bandwidth and spectrum will become possible due to higher data throughput capabilities. Also expected is the use of SDRs for more satellite based services, such as Starlink internet provider, especially as more commercial SDRs become capable of receiving in the Ka/Ku bands. Also in the satellite industry, newer GNSS satellite constellations, such as China’s BeiDou-3 and Europe’s Galileo, will require more ground station based tracking and monitoring systems in which SDRs are well suited for.

Per Vices has extensive experience in designing, developing, building, and integrating SDRs for many applications including radar, GPS/GNSS, low latency, spectrum monitoring and recording, interoperability, medical, test and measurement, and electronic warfare. Contact solutions@pervices.com today to see how we can help you with your SDR needs.